The benefits landscape has dramatically transformed in recent years, leaving employers grappling with how to meet the diverse needs of their multigenerational workforce.

As the youngest workers and with less experience selecting employee benefits, Gen Z employees may not understand their health needs completely, let alone the coverage options available or even how to find a doctor. Employers have a responsibility to offer the education and support their youngest employees might need to get appropriate health care—and boosting benefits engagement among Gen Z could potentially translate into increased employee engagement and productivity. On top of that, fostering benefits literacy and healthy habits in Gen Z employees could contribute to a healthier workforce in the future, as these employees age.

In this article, we'll explore what employers can do to help support Gen Z employees as they navigate their benefits, health and financial lives.

What Employers Should Know About Gen Z

Born between 1997-2012, Gen Zers are still entering the workforce. They already outnumber working Baby Boomers and, by 2030, this generation will account for approximately 30% of the workforce, according to Johns Hopkins University research in 2023. This figure will continue rising as the youngest members of the generation reach adulthood. Gen Z will be the only growing generation in the workforce for the next five years, when the oldest members of Generation Alpha begin working.

According to the 2025 State of Employee Benefits report, Gen Z has a unique benefits profile:

- Highest high-deductible health plan (HDHP) participation among all generations in the workforce, when offered alongside traditional health plans.

- Uses less health care than all other generations—a whopping 25 percent had zero medical insurance claims in 2024.

- 15 percent saw an out-of-network provider at least once.

- 74 percent receive regular preventive screenings.

- 81 percent want more information about benefit options throughout the year.

Based on these figures, we can make a few adjustments. This generation expresses a desire to take care of their health, but they may not understand how to use their coverage or feel they have the financial resources to do so. Hence, they’re more likely to choose high-deductible plans and underutilize the coverage they do have. Combined with their desire to receive value for their money, your youngest employees may expect a higher degree of advice, information and guidance when choosing and using their benefits.

What Makes Gen Z’s Benefits Needs Unique?

Forbes’ 2024 Top Workplace Benefit Trends By Generation survey revealed that the top benefit Gen Z employees crave is flexible work, with 83 percent listing it as most important to their job satisfaction. Data from a 2025 Newsweek article states that roughly 13 percent of Gen Z are already parents, for whom flexible parental leave could be a high priority. Given that older members of Gen Z are now entering their late 20s, we may see flexible leave options become pivotal as more Gen Zers add children to their families.

Meanwhile, Gen Zers feel stressed about how money (or lack thereof) impacts their well-being. According to Deloitte’s 2025 Gen Z and Millennial survey, cost of living and mental health are their top two concerns. Employers that can address these concerns through employee benefits offerings—while providing the assistance and resources employees need to access those benefits—will potentially see a return on that investment in the form of increased engagement and satisfaction. Benefits that are relevant to employees’ needs may help boost their engagement and satisfaction, while also helping to support their overall well-being.

Deloitte’s survey also revealed that over 50% of Gen Z cited a better work-life balance and flexible work hours as reasons for changing their careers of employers. Employers can respond to these desires by offering benefits that support these priorities. Flexible benefit options—from floating mental health days to supplemental plans like pet insurance and student loan repayment—can help younger employees design a bespoke benefits experience that meets their needs.

Gen Z health insurance premiums are the lowest of any generation — averaging $1,400 annually in 20251 — but are rising at a similar rate to other age groups. This is unsurprising given that Gen Zers are relatively minimal users of health care, as they are still in what could be considered “their prime”.

Experian Study: Average U.S. Consumer Debt and Statistics from 2025 shows that most Gen Z employees have a relatively small amount of debt compared to the three older generations that precede them. However, Experian’s data also reveals that this debt is also rising at a higher rate than that of older generations, with the average Gen Z debt rising by 30.9 percent from 2023-24 compared to just 1.5 percent for Gen X.

Benefits Solutions for Gen Z

Since Gen Zers are in the early stages of their careers and global economic conditions are somewhat uncertain, money is likely to be tight. As such, they may limit spending on non-essential coverage and prefer health plans that minimize premiums.

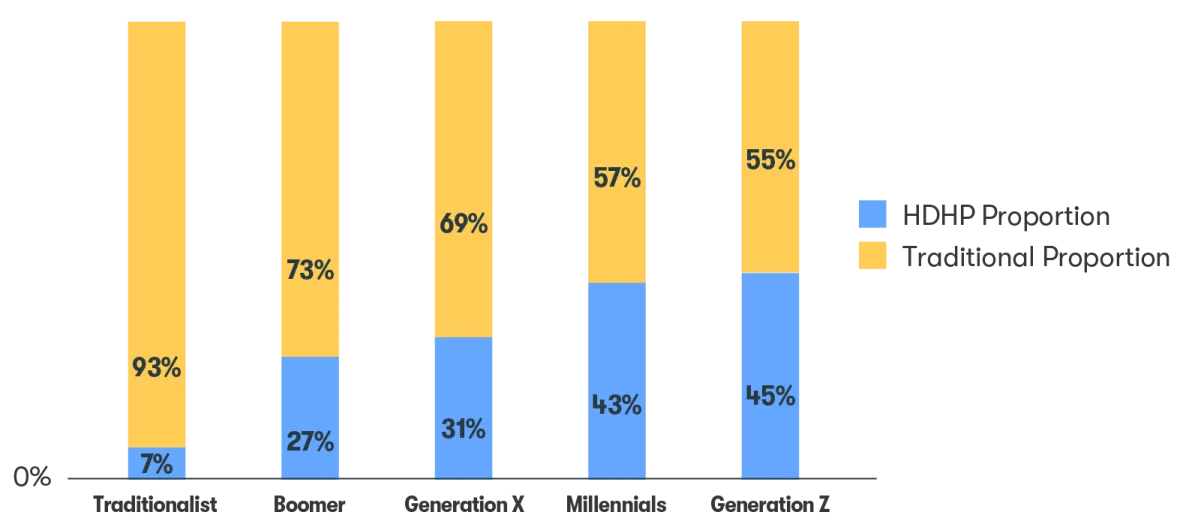

This is why Gen Z, unsurprisingly, has the highest adoption rate of HDHP plans, as noted in Figure 1.3 in the 2025 State of Employee Benefits Report. Employers should be sure to offer plans and supporting products that consider this need. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide eligible Gen Z employees with flexible savings options to help them cover qualifying medical expenses.

Figure 1.3: 2025 Generational Participation When Both HDHP and Traditional Plans Are Offered

Employers can consider offering more flexible voluntary benefits, including wellness programs, mental health care, flexible work, financial planning tools and experiences like live events. Critically, though, Gen Z employees are likely to expect these benefits to be offered at no cost to them or at low cost.

Since Gen Z is relatively new to the workforce, they will most likely struggle to understand their supplemental and voluntary benefits options. However, this challenge is not limited to younger employees. Research from LIMRA’s 2024 BEAT Study shows that over 50 percent of employees lack a full understanding of voluntary benefits such as critical illness* insurance, hospital indemnity insurance, long-term disability income insurance and accident insurance. A 2024 Voya Financial Consumer Insights & Research survey revealed that 90 percent typically select the same plan2 they chose the previous year rather than reassessing which plan may provide optimal coverage for their needs. The lowest cost coverage might be plenty for a single, child-free 20-year-old employee in good health, but it may not be adequate for a 27-year-old married parent with a new chronic illness diagnosis.

Given this, employers should recognize that benefits education, decision support and care navigation tools are essential to help younger employees understand their options when selecting and using their benefits, while also helping to protect their financial health.

Tips for Engaging Gen Z in Their Benefits

Gen Z is the most likely generation to prefer digital experiences over more traditional helpdesk support, and this preference extends to benefits advice and guidance.

- Optimize the user experience: Gen Z are digital natives, and they likely expect intuitive digital services with an outstanding user experience. As the first generation to grow up with smartphones and social media, they expect digital services to work flawlessly on mobile devices.

- Deliver an omnichannel approach: Omnichannel is an excellent benefits strategy. It ensures that all employees can access benefits-related information and services in the way they find most convenient, which is essential for maximizing engagement.

- Offer holistic solutions: Employers should consider adopting modern benefits engagement solutions that cover the full benefits lifecycle, from education and decision support to benefits management and identifying suitable providers. Solutions that keep pace with typical consumer services like social media and online banking can help provide a familiar user experience that helps to maximize engagement.

Supporting Gen Z is an Investment in the Future

At Benefitfocus, we help organizations make optimal decisions about the benefits they offer, and support employees of all ages to choose and use their benefits to maximize their health and financial outcomes. In other words, we support an exceptional employee benefits experience.

Some of our offerings include:

- Our industry-leading technology platform simplifies administration and is intended to help drive efficiencies through automation so organizations can focus on strategic initiatives for their Gen Z workforce, such as increasing their health literacy.

- We make it easy for Gen Z employees to understand and make benefits decisions through a connected experience across health, retirement & savings.

- We support employee-first health and financial outcomes through powerful insights and a personalized experience that engages them year-round.

- Employees cite health benefits and retirement planning as the top two retention benefits, helping your organization build a stronger workforce and control hiring costs for years to come.

If you think your organization may be interested in these outcomes, you can find out more on our website.