When the oldest Gen Xers became adults in the early 1980s, the economy was marked by two back-to-back recessions, according to 2025 data from National Bureau of Economic Research. Today, as those same people inch closer to retirement age, inflation and economic uncertainty abound once more, contributing to the financial pressure Gen Xers may feel.

Gen X is sometimes referred to as “the forgotten generation” as noted in a 2025 Forbes article. Sandwiched between two larger generations—Baby Boomers and Millennials—Gen X should not be overlooked.

In this article, we'll explore what employers can do to help support Gen X employees as they navigate their benefits and transition into the remaining years of their careers.

What Employers Should Know About Gen X

Gen X was born between 1965-1980 and makes up the second largest share of the U.S. workforce at 31 percent, based on 2024 research from the U.S. Department of Labor. With the youngest Gen Xers entering their mid-40s, health care needs and the urgency of retirement planning may be increasing. In 2023, Fortune reported that Gen X also has the largest wealth gap of all living generations, in large part due to lack of pensions and rising cost of living. These challenges may add to the pressure of choosing the most appropriate benefits coverage.

According to the Benefitfocus 2025 State of Employee Benefits report, Gen X are:

- More likely to choose traditional health plans when offered alongside high-deductible health plan (HDHP) options.

- Utilizing more health care than younger employees, with 2x the prescription claims of Millennials in 2024. Among all working generations, Gen X also has the highest usage of glucagon-like peptide agonists (GLP-1s) — medications approved and used for Type 2 Diabetes and weight management.

- Seeing out-of-network providers at least once (15 percent in 2024) — a slightly higher rate than younger employees.

- Receiving regular preventative screenings (78 percent in 2024).

- Wanting more information about benefit options throughout the year (65 percent).

As Gen X navigates an increasing need for health care amid financial constraints, they appear more risk averse than younger generations. This poses an opportunity for employers to provide more support, so that Gen Xers can feel confident their benefits selections offer the value they need for their rising costs.

What Makes Gen X Benefits Needs Unique?

Flexibility is a major motivator for Gen X. According to a 2025 Forbes survey, the top desired benefit for Gen X is flexible work (73 percent), followed by flexible PTO and vacation (67 percent), mental health resources (66 percent), and flexible parental leave options (65 percent).

The 2025 Forbes survey also notes that when it comes to mental health benefits, Gen X is the least likely generation to be interested in wellness reimbursement, with only 18 percent listing it as a priority. Instead, they were more likely to want insurance coverage for mental health (50 percent), dedicated office spaces for processing (48 percent), and dedicated workplace therapists or counsellors (43 percent).

On the other hand, Forbes’ survey found that Gen X is the generation that most desire professional development support. Many Gen X employees want company-wide training from other departments (55 percent), access to learning management systems (50 percent) and a stipend for continued learning (45 percent).

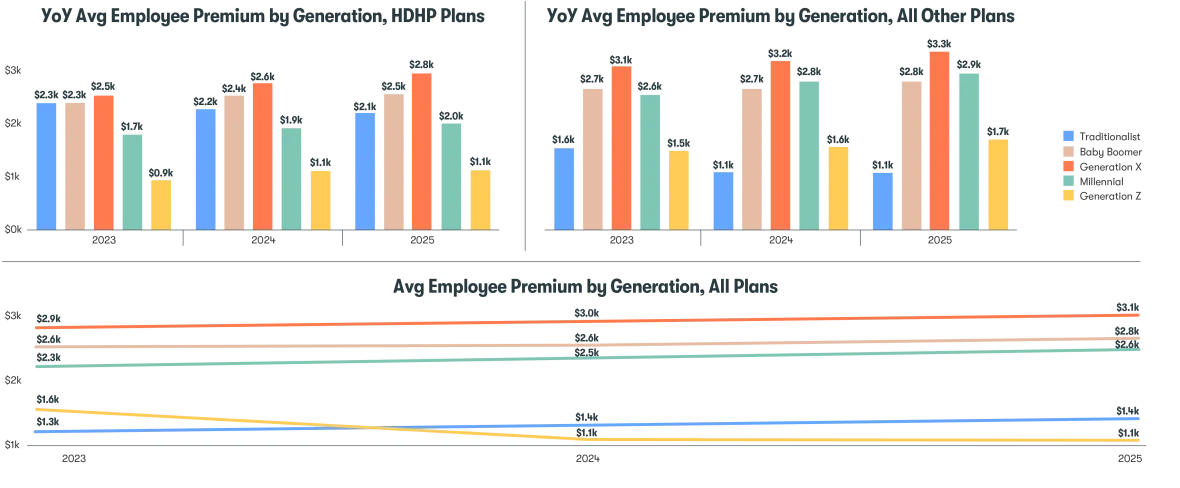

Notably, the 2025 State of Employee Benefits research shows that Gen X has the highest average employee premiums of any generation — $3.1k in 2025, which is almost 10 percent higher than Baby Boomers in second place1.

A 2025 Healthgrades report shows that almost three-quarters of Generation X employees are relatively frequent users of health care coverage, often receiving recommended preventive care. They’re potentially also responsible for the health care of both children and adult dependents, which may explain their higher premiums compared to other generations.

Based on 2025 SmartAsset data, Gen X has the largest amount of debt on average of any generation, though this may be due to the life stage they are experiencing. This suggests that a significant amount of their income could be tied up in repayments. Fortunately, a 2025 Experian study states that this debt is also rising at a slower rate compared to younger generations.

Benefits Solutions for Gen X

Gen X employees are likely to be interested in a wide range of voluntary benefits due to their propensity to be married, have dependents, own their own homes, have pets, etc. They may also be increasingly interested in retirement planning and associated benefits in the coming years.

Since Gen X are increasingly heavy users of health care — including for management of chronic conditions — effective care navigation solutions are likely to be well received. These tools can aid in selecting and best using benefits suited to an individual’s situation and needs.

High debt repayments may make Gen X more discerning purchasers of health care, which in turn may influence their uptake of care navigation tools. They need to be careful with their decisions to maximize their health outcomes while minimizing the impact on their current finances and retirement planning. As a result, Gen X employees may also be interested in voluntary benefits related to financial planning and debt management.

Like Baby Boomers, employers might expect Gen X employees to be more savvy about their benefits selection and use than younger generations. However, a 2024 Voya survey2 revealed that at least one quarter of all employees — regardless of generation — are confused by their benefits. A 2025 Voya survey found that 96 percent of employees selected the same plan3 they chose the previous year.

Engaging Gen X in Their Benefits

Since Gen X are relatively heavy health care users and have the highest premiums, it’s crucial that they make the best health and financial decisions for their specific situation. Care navigation tools can help your Gen X employees make these decisions confidently — for example, choosing the right care and providers for their needs — so they can avoid overpaying and have the best chance of a positive health outcome and financially secure retirement.

Similar to younger generations, Gen X is technologically competent and expects intuitive and accessible digital experience. However, some Gen Xers may still prefer to talk to an expert over the phone before making important decisions.

An omni-channel approach that incorporates both digital and traditional channels is an excellent benefits communication strategy, as it ensures all employees can access benefits-related information and services in the way they find most convenient. This gives employers the best chance of maximizing engagement and improving outcomes for both employers and employees.

Supporting Generation X Shows They are Not Forgotten

At Benefitfocus, we help organizations make informed decisions about the benefits they offer, and support employees of all ages to choose and use their benefits optimally to maximize their health and financial outcomes. In other words, we support an optimal employee experience.

Working with our experienced benefits team can provide the following advantages:

- An industry-leading technology platform: Our platform is designed to simplify benefits administration, drive efficiencies and enable organizations to focus on strategic initiatives for Generation X employees, including mental health coverage and financial planning support.

- A personalized user experience: We make it easy for Gen X employees to balance cost and risk by making optimal benefits decisions through a connected experience across health, retirement & savings.

- Data-driven insights: We support employee-first health and financial outcomes through powerful insights and a personalized experience that is intended to engage employees year-round.

- Talent retention strategies: A 2024 SHRM report states that health benefits and retirement planning are the top two retention benefits. Optimizing your benefits program can be an effective strategy to help build a stronger workforce and control hiring costs now and into the future.

If you think your organization may be interested in these outcomes, you can find out more on our website.