Many a meme has attempted to encapsulate the Baby Boomer attitude and ethos. However, Boomers are full of surprises, even when it comes to their relationship with their workplace benefits.

Boomers were (true to their name) the largest portion of the population on the planet until 2020, when they were overtaken by the Millennial generation, as noted in a 2023 CNN article. When the oldest Boomers began to retire, many employers may have been unsure how to serve shifting segments of the multigenerational workforce. In recent years, innovative benefits products and plans also emerged, challenging employers to educate employees about new options.

Baby Boomers, in particular, have witnessed significant shifts in the benefits industry throughout their working lives. In this article, we'll explore what employers can do to help better support them as they navigate their benefits and retirement planning.

What Employers Should Know About Baby Boomers

The Baby Boomer generation, born between 1946 and 1964, makes up only 15 percent of the workforce, according to the U.S. Department of Labor in 2024. The youngest Boomers will turn 65 in 2030 but—as we’ll explore below—many are not planning to retire at that age, or at all. Since employers may have planned benefits options based on the assumption that Boomers would retire at 65 (or even younger), this could create a disconnect between the benefits offered and what Boomer employees actually need.

According to the 2025 State of Employee Benefits report, Baby Boomers tend to:

- Have the lowest high-deductible health plan (HDHP) participation, when offered alongside traditional health plans. However, at 27 percent, Boomers opt for HDHP just four points below the next youngest generation.

- Use the most health care—Boomers have the highest number and highest average cost of medical claims, at 17 and $10,316 respectively.

- See out-of-network providers at least once per year (17 percent), which is more than younger age groups.

- Receive regular preventative screenings (80 percent).

- Want more information about benefit options throughout the year (45 percent).

Based on this data, we might infer that Boomer employees feel confident that they understand their benefits and know how to use them—and they’re the only generation in which less than half of employees want more benefits information. However, that doesn’t mean employers should not prioritize education and support for their oldest employees.

Baby Boomers’ Benefits Needs and Consumption

A 2025 PR Newswire article reveals that over 11,000 Americans turn 65 each day. However, a 2024 Fortune article states that many are choosing to delay retirement for various reasons — including financial security, a desire to stay active and a sense of purpose and fulfilment. In 2025, Newsweek reported that as many as 51 percent of Boomers expect to work indefinitely. All of this suggests that retirement and financial planning are likely to be top priorities for your oldest employees.

According to a 2024 Forbes study, Baby Boomers prioritize flexibility as the most important factor in their satisfaction. Flexible work options (76 percent) and flexible PTO and vacation (60 percent) are some of the most prized benefits.

While other generations listed insurance coverage as their most important benefit, Boomers broke the mold by listing dedicated office space for processing as the most desired benefit. They were also the most likely to desire company-wide training from other departments. Other sought-after professional development benefits include:

- Access to learning management systems (57 percent).

- Stipend for continued learning (51 percent).

- Performance reviews (51 percent).

Retaining older employees—so your organization can continue to benefit from their knowledge and experience when they want or need to continue working—should be a top consideration for today’s employers. Leaning into benefits planning and strategy that delivers for Boomers can be an effective way to help support your retention efforts.

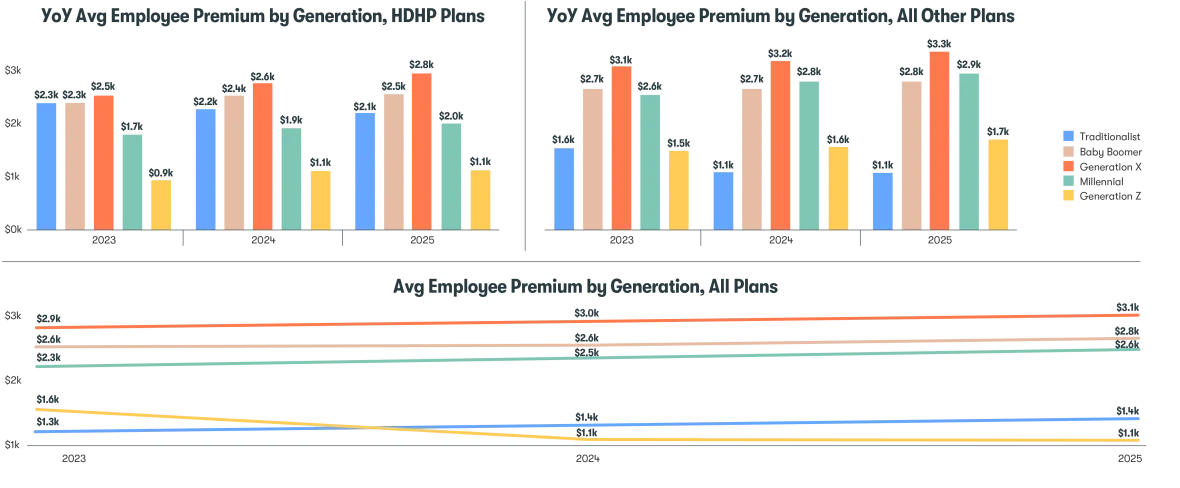

Meanwhile, average premiums for this generation in HDHP plans and all other plans have risen by around 7.5 percent since last year.1 However, Baby Boomers have the second highest premiums of any generation, just behind Gen X.

Benefits Solutions for Baby Boomers

Voluntary benefits and support related to retirement planning may be more appealing to your oldest employees than younger generations — not just because they are closer to retirement age, but also because they are at higher risk of running out of retirement savings than their younger counterparts, as reported by Nasdaq in 2024. In light of this, employers may want to consider providing support and benefits geared towards financial and retirement planning and saving.

Unsurprisingly, Baby Boomers also have much higher rates of chronic conditions and certain other health care issues, according to 2024 research from Altera. These conditions can become very costly — particularly if employees make suboptimal decisions when choosing and using their health care benefits. Benefits, education and decision-making tools related to managing chronic conditions can all support Boomers as they navigate their health care choices.

Finally, employers might assume that Baby Boomers are more likely to understand their benefits options than younger generations, given their years of experience. However, 2024 Voya research indicates:

- 27 percent of all employees are confused by their benefits2

- 91 percent of employees say they typically select the same plan3 they chose the previous year, rather than reassessing which is best for their needs.

In light of this, it’s best to assume that all employees — Boomers included — could use more support in choosing the right benefits for their needs and making optimal use of them.

Engaging Baby Boomers in Their Benefits

The obvious difference between Baby Boomers and younger colleagues is that they may prefer to receive support over the phone rather than exclusively online. However, support representatives must be well informed and able to help effectively — and to that end, there is huge opportunity for customer service employees to access technology solutions like Care Navigation tools on behalf of Boomer employees.

That said, some Baby Boomers are more comfortable with technology than you might expect. Technology began changing the face of business in the 1980s, and this generation has experienced the entire scope of this process.

Again, care navigation solutions can maximize health and financial outcomes by supporting employees through the process of choosing and engaging with care—a key factor for folks with the highest health care needs.

Beyond this, engagement solutions that offer a range of communication channels will allow Baby Boomer employees to interact with benefits professionals in a manner that suits their needs. While Baby Boomers are often happy to use technology solutions, they may prefer to finalize their decisions by speaking to someone with this expertise.

Supporting Baby Boomers Eases the Generational Shift

At Benefitfocus, we help organizations make informed decisions about the benefits they offer, and support employees of all ages to choose and use their benefits optimally to maximize their health and financial outcomes. It’s important to support an optimal employee experience for Baby Boomers, considering their increased medical needs compared to younger colleagues.

Partnering with our team of experienced benefits administration professionals can help your organization:

- Simplify benefits administration – Our industry-leading technology platform simplifies administration, drives efficiencies and enables organizations to focus on strategic initiatives for their Baby Boomer employees, such as maximizing retirement savings and managing the rising cost of health care.

- Better support your employees – We make it easier for Boomer employees to feel confident about their benefits during the final years of their professional careers.

- Gain insight into your employees’ benefits needs – We understand how to support and optimize employees’ health and financial outcomes. Our strategies include powerful insights and a personalized experience that engages employees year-round.

- Enhance its talent retention strategy – Employees cite health benefits and retirement planning as the top two retention benefits, according to a 2024 SHRM report. Our benefits administration solutions are intended to help your organization build a stronger workforce and control hiring costs into the future.

If you think your organization may be interested in these outcomes, you can find out more on our website.