Each year, our State of Employee Benefits Report provides a snapshot of the trends shaping how U.S. employees use and engage with their health and financial benefits. The 2025 edition reveals a familiar challenge: while employers continue investing in a broad range of benefits, many employees still don’t fully understand or use them.

This persistent engagement gap not only affects employee health and satisfaction—it can also drive up organizational costs. As health care spending and financial stress reach new highs, it's more critical than ever for employers to foster benefits understanding, improve access, and support proactive use.

The Engagement Gap: A Continuing Issue

Despite years of investment in expanded benefits programs and employee education, many employees remain disconnected from their available options. A significant portion of employees delay care, skip preventive screenings, or misunderstand the value of their benefits altogether.

Our research revealed that:

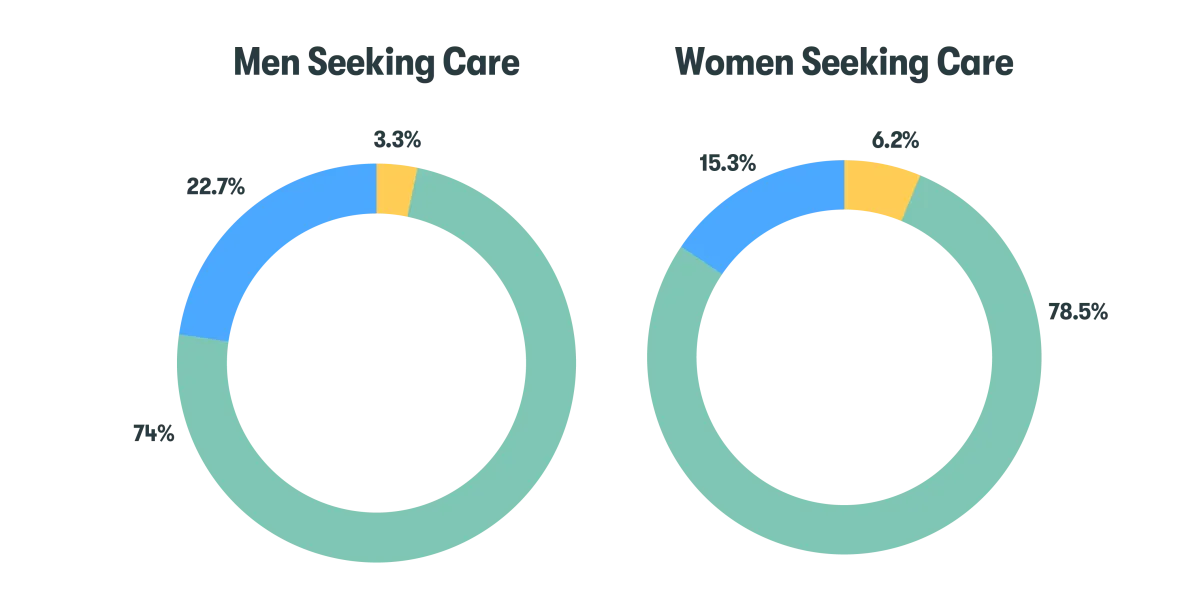

- Some people (mostly men) are delaying or deferring care (15.3% of women had a gap in care vs. 22.7% of men).

- There is also a gender gap for preventive screenings (78.5% of women had at least one screening, compared with 74% of men).

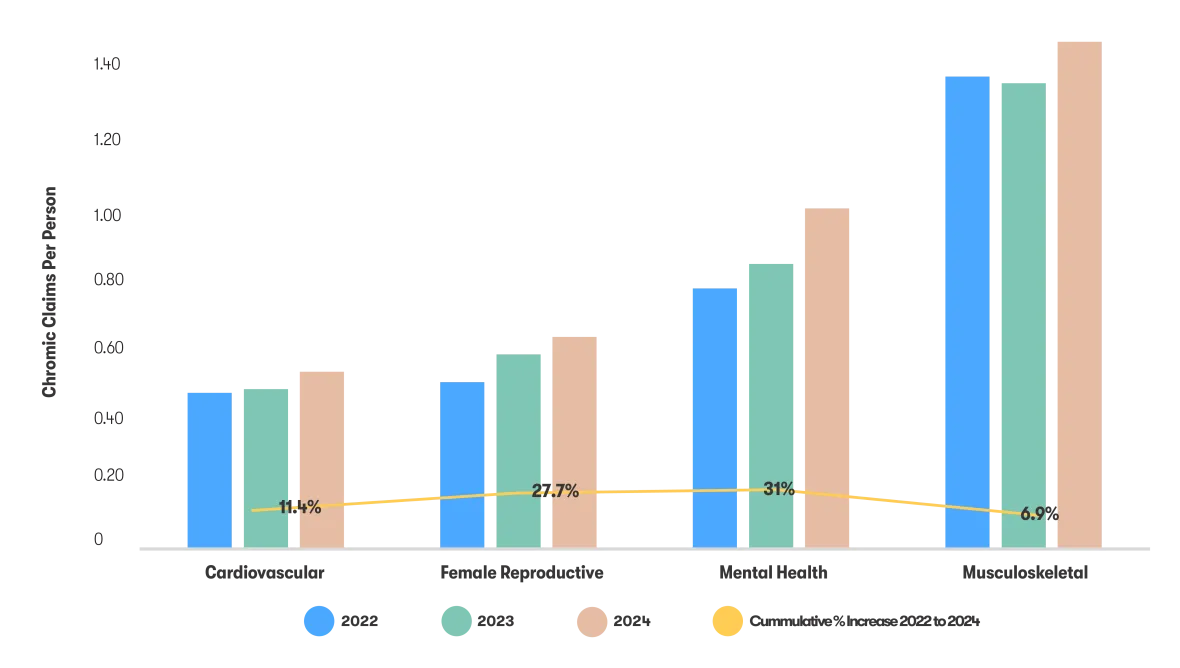

Claims for chronic conditions rose 11.5% for the top conditions we track (cardiovascular, reproductive, mental health, and musculoskeletal) from 2023 to 2024.

Chronic Condition Trends 2022-2024

These patterns aren’t just health concerns—they’re cost concerns. Delayed care can result in more advanced conditions that are harder (and likely more expensive) to treat. Employees with unmanaged health issues may be more likely to miss work, be less productive, or experience long-term burnout.

Employers that fail to close the benefits engagement gap may risk higher healthcare claims, lower retention, and a less resilient workforce. The data makes one thing clear: even the best-designed benefits plans won’t deliver value if employees aren’t using them.

Rising Healthcare Costs & Financial Stress

The cost of healthcare is rising, driven by multiple factors—including an uptick in chronic disease, high-cost specialty medications, and general inflation in medical services.

This year’s report shows:

- Overall medical inflation grew 12.6% on average over the last two years.1

- Overall prescription inflation rose 15% on average over the last two years.1

One rapidly growing trend contributing to cost increases is the use of GLP-1 drugs, for diabetes and weight management. These medications tend to come with a hefty price tag, raising questions about long-term sustainability and coverage strategy. We found the average cost per employee on GLP-1 is an additional $6,376 per year in medical (that’s 89% more than average) and $11,806 per year in prescription claims (that’s 425% more than average), compared with people not taking those medications.

At the same time, employees are struggling with out-of-pocket expenses. Financial stress remains a top concern, and we find it’s directly impacting well-being and workplace engagement. When people are worried about money, they may be less likely to seek preventive care, manage chronic issues effectively, or engage with wellness resources—all of which can carry downstream costs for employers.

Generational Differences in Benefits Usage

Employees across generations want benefits that meet their personal needs, something that can vary dramatically.

Baby Boomers, for example, are more likely to prioritize chronic condition management, prescription coverage, and traditional health plan features. Meanwhile, Gen Z and Millennials tend to take advantage of mental health services, virtual care access, and tools that support holistic wellness. Overall, younger employees use their benefits less (based on number of claims and average cost of claims), while Baby Boomers and Gen X get the most care—and also account for the highest proportion seeing out-of-network providers, which can further drive up costs.

A one-size-fits-all approach is not effective. Employees expect benefits that are tailored not just to their demographics, but to their life stage, goals, and health priorities. Employers that offer guided decision support, personalized plan guidance, and digital-first tools have an opportunity to better meet the diverse needs of a multigenerational workforce.

Personalization isn’t just a nice-to-have—we find it’s essential for improving engagement, satisfaction, and the return on investment in your benefits programs.

The Growth of Supplemental & Voluntary Benefits

In 2025, we see an increase in offerings and participation in supplemental and voluntary benefits like accident insurance, critical illness or specified disease insurance, and hospital indemnity insurance.

Here’s the evidence:

- Supplemental and voluntary offerings have increased to 43.49% in 2025 from 41.27% in 2023.

- Participation rates increased year-over-year in every generational group for every supplemental benefit we track.

This demand is driven by both financial pressure and lifestyle changes. Many employees, especially younger generations, want to personalize their benefits mix to fit their budget and risk profile. Others are looking for support in areas not traditionally covered by core plans—like expanded reproductive health, gender-affirming care, and financial wellness tools.

These programs aren’t just perks—they’re signals that employers are listening. By offering a broader menu of optional benefits, organizations help empower their people to make choices that align with their needs and values.

The Future of Employee Benefits Begins with Engagement

The 2025 State of Employee Benefits report reinforces a core truth: benefits only work if employees use them. By investing in engagement, personalization, and communication, employers can drive better health outcomes, improve workforce satisfaction, and control rising costs. As the healthcare landscape continues to evolve, the organizations that prioritize proactive, people-first benefits strategies will likely be well positioned for long-term success.

Stay tuned, the full 2025 State of Employee Benefits Report will be coming out soon.

1 Based on normalizing the observed medical costs by controlling for demographics.

Methodology

The State of Employee Benefits 2025 was compiled from enrollment transactions aggregated across 316 large employers (1,000+ full time employees) within the Benefitfocus customer base, representing more than 1.8 million employees in total. The data was evaluated on an anonymous basis. Enrollment records include both active and passive enrollments made by a variety of industry roles (employee, carrier representative, broker, benefits administrator, etc) from the fall of 2021 through fall of 2023 for plan year effective dates of January 1. These measurements are not meant to be a nationally representative sample, but to represent the aggregate activity for large employers on the Benefitfocus platform.3

For data related to medical and prescription drug claims, Benefitfocus drew from 87 employers in our Health Insights Platform with a total population of approximately 800,000 employees and their dependents. Claims were assessed based on a fiscal year ended 9/30 to account for lags in claim processing. Effects were estimated using a random sample of approximately 10,000 of the aforementioned individuals and where that sample size was insufficient, certain aggregate results were drawn from the population itself. The underlying claims demographics and claims were sanitized per HIPAA Safe Harbor guidelines and were filtered to exclude generations older than Baby Boomers to comply with the age 90 cutoff mentioned in section (2)(i)(C) of "Guidance on De-Identification of Protected Information. November 26, 2012."

Benefitfocus has provided this as an educational resource. This is for informational purposes only and not intended to provide advice or address the situation of any individual or entity. The topics addressed may have legal, financial, and health implications, and we recommend you speak with a legal, financial, or health advisor before acting on any of the information presented.

Benefitfocus is not an actuarial firm, and Benefitfocus is not acting as an actuary or determining any actuarial basis for employer benefit offerings. Benefitfocus does not underwrite insurance and does not give legal advice regarding the adequacy of coverage limits or types. The State of Employee Benefits Report is not a substitute for the advice of an attorney, tax, actuarial or other professional advisors.

Benefitfocus.com, Inc. and its affiliated companies (collectively, “Benefitfocus”) is making available to you the Personalized

Decision Support tool offered by SAVVI Financial LLC (“SAVVI”). Benefitfocus is a Voya Financial(“Voya”) business. Voya

has a financial ownership interest in and business relationships with SAVVI that create an incentive for Voya to promote

SAVVI’s products and services and for SAVVI to promote Voya’s products and services. Please access and read SAVVI’s Firm

Brochure, which is available at this link: https://www.savvifi.com/legal/form-adv. It contains general information about

SAVVI’s business, including conflicts of interest.

CN4432572_0427